Regulations on Special Relationship in Customs Valuation

Author: Sean Jia Jing Ning 2020-08-10Special relationship has always been an inevitable problem for transnational corporations in value determination, and it is also the focus of supervision for Customs valuation procedure. Since March 2016, the Customs has added three declaration elements of price information in the declaration of imported goods -- confirmation of special relationship, confirmation of price impact and confirmation of royalties payment. On one hand, it will enhance the obligation of enterprises to voluntarily declare price information. On the other hand, it will provide evidence reference to clarify the responsibility in the follow-up supervision procedure (for example, whether the enterprise has the subjective malice of price deception). For enterprises, in order to effectively respond to the question of the Customs about the impact of special relationship on transaction price, it is necessary to understand the provisions on special relationship in customs valuation. This paper introduces this issue for reference.

Ⅰ. What is the special relationship in customs valuation?

According to Article 16 of Measures for the Customs to Examine and Determine the Duty-paid Value of Imported and Exported Goods (hereinafter referred to as “the Measure”), under any of the following circumstances, the buyer and the seller shall be deemed to have a special relationship:

1. the buyer and the seller are family members;

2. the buyer and the seller are mutual senior officer or directors for each other;

3. one party is directly or indirectly controlled by the other party;

4. both the buyer and the seller are directly or indirectly controlled by a third party;

5. the buyer and the seller jointly control over a third party directly or indirectly;

6. either party owns, controls or holds 5% or more (inclusive of 5%) of the voting shares of the other party directly or indirectly;

7. one party is an employee, a senior officer, or a director of the other party; or

8. the buyer and the seller are both members of a partnership.

Where the buyer and the seller are related in business, or one party is the exclusive agent, exclusive distributor, or exclusive assignee of the other party, if they also meet one of the conditions above, they shall be deemed to have a special relationship.

Ⅱ. How to deal with special relationship?

(Ⅰ) Is it necessary to fear about special relationship?

(Ⅱ) Enterprises can prove that the special relationship has no effect on the transaction price of the imports from the following two perspectives.

1. Providing test prices

The test prices can be provided for the Customs as follows:

· the transaction price of identical or similar imports sold to a buyer in China which does not have a special relationship with the seller;

· the duty-paid value of identical or similar imports determined in accordance with the deductive price valuation method; or

· the duty-paid value of identical or similar imports determined in accordance with the computed price valuation method.

Where there is a special relationship between the buyer and the seller but the taxpayer is able to prove that the transaction price is close to any of the aforesaid prices in the transaction generated at or around the same time, the special relationship shall be deemed to have no effect on the transaction price of the imports.

Lawyer Advice When making a comparison the aforesaid 3 prices, the Customs shall consider the difference in commercial standard and import quantity, as well as costs difference caused by special relationship.

2. Examining sales environment

Examining sales environment means that when determining whether the special relationship affects the transaction price, the Customs often needs to examine both parties’ sales environment, and requires the enterprises to provide information to explain how the invoice or contract price is reached, whether the declared price conforms to the normal pricing practice of the industry, whether it is in line with the sales price of a third party with no special relationship, and whether the profit is in line with profit level of similar goods, etc. Enterprises need to seize the opportunity to provide the Customs with materials that can prove that the declared price is fair and reasonable. Once these materials are examined and accepted by the Customs, it can be determined that the special relationship has not affected the transaction price of imports.

Summary

special relationship ≠ denying valuation method based on transaction price

It can be proved that the declared price is fair and reasonable by providing test prices or examining sales environment.

Ⅲ. Law enforcement means in customs valuation for special relationship

(Ⅰ) The Customs may require enterprises to submit the following materials when determining the special relationship:

1. annual financial and accounting statements and audit reports of the past three years;

2. import condition, including the commodity description, specification, price list, supplier list, etc.;

3. list of affiliated enterprises and the relationship among them, including the structure of transnational corporations and the division of labor among affiliated enterprises;

4. transactions with affiliated enterprises, including the purchase, sales, transfer, use, and financing of tangible and intangible properties with affiliated enterprises, as well as provision of labor services,etc.;

5. pricing policies of affiliated enterprises, including purchase and sales; and

6. internal control of the audited affiliated enterprises, including the internal control system and accounting system.

Where the adjustment factors are included in the pricing polices of the audited affiliated enterprises, the Customs may require the audited affiliated enterprises to provide relevant materials to prove the authenticity and rationality of the pricing policies selected.

(Ⅱ) Official powers that the Customs may exercise in price examination

The Customs may exercise the following official powers in price examination to verify the authenticity and accuracy of declared prices:

1. to inspect and duplicate the contracts, invoices, account books, payment vouchers, documents, business correspondence, audio and video recordings and other commercial documents, written materials, and electronic data indicating the relationship between both parties and the transaction activities;

2. to investigate the taxpayers and the individuals, legal entities, or groups relating to the taxpayers in business or capital transactions with the questions about import and export prices;

3. to inspect imports and exports or take samples for inspection or laboratory testing;

4. to enter the factories, business premises, warehouses of the taxpayers to inspect the import and export goods and examine the operation conditions;

5. to acquire the financial information of the taxpayers’ corporate accounts set up in banks or other financial institutions and to report the condition to the banking regulatory authorities accordingly, by presenting the “Notice of the PRC Customs on Account Enquiry” (see Annex 1) or the staff work certificate of the Customs, upon approval by the director-general of the direct superior Customs authority or the director-general of the authorized subordinate Customs authority; and

6. to make enquiry with tax authorities on the status of tax payment in relation to the imports and exports in China.

Lawyer Advice

1. In view of the price problem, in addition to price check, the Customs can also carry out special inspection on this issue if necessary. If any illegal behavior is found in the inspection, it shall be further transferred to the anti-smuggling department for case investigation.

2. As for the examination of price problem, the applicable laws and regulations and law enforcement procedures of customs price check, special inspection and case investigation are different. As the examinee, the focus of response and responsibility risks are also different. Therefore, when the Customs initiates relevant law enforcement procedures, enterprises are advised to seek help from professional lawyers in a timely manner.

Ⅳ. Examination of transfer pricing in customs valuation of special relationship

(Ⅰ) Transfer pricing

Transfer pricing refers to the prices of goods, services and technologies that exchanged between parent-subsidiary corporations, and among subsidiaries within a transnational corporation, which is a commonly-used means of international capital management, in order to avoid the political and tax barriers set up by some host countries and reduce the cost of foreign exchange transactions【1】.

Transfer pricing and special relationship: Transfer pricing and affiliated transactions are inseparable. Affiliated companies may set or add commercial or financial conditions different from those of unrelated enterprises, violating the principle of independent competition and affecting the fairness and rationality of transactions. Considering the tax risks that may arise from the pricing method of affiliated transactions, whether the special relationship between affiliated companies affects the transaction price (including whether the transfer pricing policy is fair and reasonable) is the focus of customs valuation. In short, transfer pricing is related to the fairness and rationality of prices in affiliated transactions, and it is also an important aspect for the Customs to judge whether the special relationship between transnational companies affects the declared price.

(Ⅱ) There are differences between Customs and tax authorities in the examination of transfer pricing.

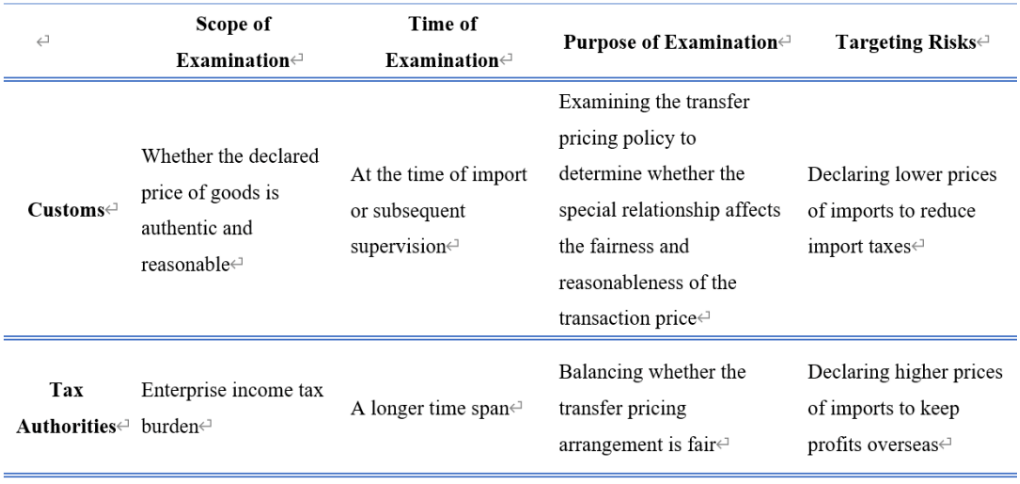

Although both Customs and tax authorities are concerned about whether the transfer pricing policy of transnational groups is fair or not, their regulatory emphasis and valuation methods are different because of their different functions.

1. Regulatory emphasis

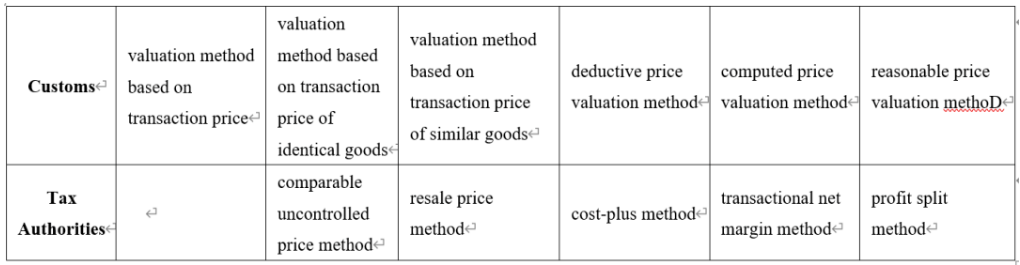

2. Valuation methods

Note:

1) There is no requirement of the applicable order for the tax authorities’ methods. The customs methods shall be applied in sequence in principle; only when the former method is not applicable, the next one can be applied. The one exception is that taxpayers may request to reverse the sequence of application of computed price valuation method and reasonable price valuation method after approval of the Customs.

2) For better understanding, we have listed and compared the price valuation methods with similar principles between the Customs and Tax authorities in a table, but it does not mean that the price valuation methods in comparison have overlapping relationships in law. Enterprises still need to comply with the legal provisions and requirements of Customs and Tax authorities when applying and interpreting each specific price valuation method.

(Ⅲ) What can enterprises do in customs examination of transfer pricing

Many enterprises notice that the Customs and Tax authorities are concerned about the fairness and rationality of transfer pricing. When dealing with the customs price valuation, they directly present the Customs with the transfer pricing report submitted to the Tax authorities. However, they find that it is not persuasive enough, and even leading a negative effect because they fail to prevent the compliance risk from the perspective of customs valuation. Thus, how should enterprises deal with the customs examination of transfer pricing?

1. Enterprise can coordinate the regulatory requirements of the Customs and tax authorities in advance starting from the overall perspective. When making transaction arrangements and transfer pricing policies, enterprises shall not only meet the price valuation requirements of tax authorities, but also reflect the fairness of related transactions from the perspective of customs valuation and price verification.

2. In daily planning and operation, enterprises also need to consciously accumulate and sort out the data proving the fairness and rationality of the pricing strategy of enterprises for verification.

3. Enterprises can give full play to the support of transfer pricing report in price fairness. Due to the different functions of the Customs and the Tax authorities, it is not a good idea to present the Customs with the transfer pricing report submitted to the Tax authorities. Enterprises need to change their mind, sort out and provide materials from the perspective of the Customs, and make timely supplementary explanations to the points where the Customs have doubts. Only in this way can the transfer pricing report play a supporting role in the fairness and rationality of the declared price.

4. In the same way, when submitting other price-related materials to the Customs, it is necessary to consider the Customs’ collection and management habits, so as to explain the fairness and rationality of the declared price from the perspective of customs price examination. In addition, the submitted evidence materials shall be able to confirm and support each other, in order to avoid contradiction and put the enterprise at risk.

5. Don’t hesitate when encountering difficulties. To consult lawyers to intervene in time, so as to accurately judge the problems and corresponding risk points, and to take targeted response measures, in case the problems will escalate due to untimely response or missing the best stop loss point due to delayed opportunity, result in expanding losses.

Reference:

[1]: 360 encyclopedia https://baike.so.com/doc/5921702-6134622.html