Customs Price Determination and Price Check

Author: Sean Jia & Jing Ning 2022-10-09Abstract: The determination of the dutiable value of imports and exports, is the key point of Customs supervision and control, and it is also the field with high risk of enterprise compliance in import and export activities. Pursuant to existing regulations on Customs supervision and control, it is the obligation for enterprises to declare the price of imports and exports to Customs fully, accurately and truthfully. Where Customs has doubts to the declared price of the enterprise, Customs shall have the right to conduct a price query, price check, price inspection and even case investigation. Once the Customs determines that the declared price is untrue or deceitful, the enterprise shall bear the corresponding administrative liability including administrative punishment, or even be handed over to procuratorial organs for public prosecution because of suspected crimes. The enterprise and even its person chiefly in charge may face criminal liability.

Although the price issue is very important, price declaration is often an area of high compliance risk because of the highly professional determination of Customs price as well as other considerations, such as the different pricing policies among affiliates of multinational corporation, definition of liability under agency import mode, etc.. In this regard, this note will make brief introductions to determination of Customs value, price check, enterprise legal liability, and compliance suggestions.

Key words: determination of Customs value, price check, legal liability

I. The main basis, methods and procedures of Customs on determination of the value

(I) Main Basis: Determination of Customs value, as the name implies, is a process in which Customs reviews the declared price of imports and exports to determine their dutiable value.

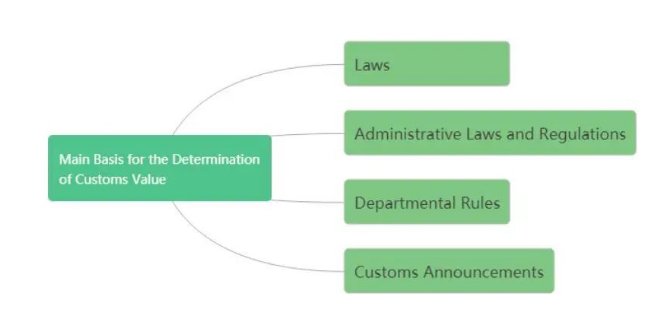

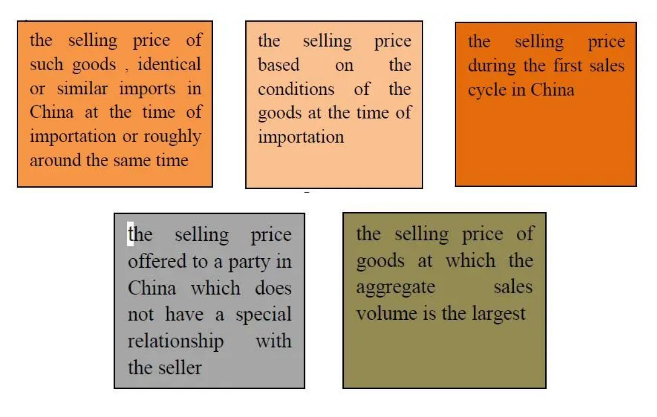

Figure 1:Main Basis for the Determination of Customs Value As shown in the figure 1, from the hierarchy of legal effect, the main basis of determination of Customs value includes laws, administrative laws and regulations, Customs rules, and Customs regulatory documents. As Customs regulatory documents are released in the form of announcements, we refer to Customs regulatory documents as Customs announcements in this note for the sake of simplicity. From the specific details of value determination, the basis of higher legal hierarchy (the legal effect of departmental rules and above) mainly includes Customs Law of the People's Republic of China, Regulations of the People's Republic of China on Import and Export Duties, Measures of the PRC Customs on Determination of Dutiable Value for Imports and Exports, Measures of the Customs of the People’s Republic of China on Determination of Dutiable Value of Bonded Goods for Domestic Sale, and Administrative Measures of the People's Republic of China on Levying of Taxes by the Customs on Imports and Exports. Apart from laws, administrative laws and regulations and departmental rules, Customs announcements play an important role in the determination of Customs value in the practice, which partly relieve the contradiction between legislation lag and reality variability, and build up a normative bridge between principle and flexibility. Announcement on Issues Relating to Determination of the Dutiable Value of Formula Pricing Imports, Announcement on Issues concerning Royalty Filing Formalities for Tax Purpose, Announcement of the General Administration of Customs on Revisions of the Relevant Provisions on Determination of Aircraft Operating Lease Dutiable Price, and Announcement on issues concerning Determination of Dutiable Value of Bonded Goods for Domestic Sale, are all examples which Customs standardizes the issue of value determination in the form of releasing announcement for specific areas or concerns. (II) Basic Methods Determination of the dutiable price of imports and exports is the core issue for Customs price determination. Pursuant to regulations stipulated in Measures of the PRC Customs on Determining of dutiable Value for Imports and Exports, we made a brief summary of the methods for Customs determining the dutiable price. 1. Determination of the Dutiable Value of Imported Goods (1) Transacted Price Valuation Method The dutiable value of imports shall be examined and determined by the Customs on the basis of the transacted price of the goods and shall include transportation and related expenses and insurance premium of the goods prior to unloading at the place of arrival of the goods in the People’s Republic of China. Points: 1) The premise of adopting of the transacted price valuation method is that the Customs examined and determined that the declared price of the enterprise complies with the provisions of Customs. 2) Where the declared price of enterprises does not comply with the provisions of Customs or where the transacted price of imports cannot be determined, the transacted price valuation method shall not be applied. 3) Where Customs determines that the transacted price valuation method shall not be applied, the Customs shall, upon carrying out price negotiation with the taxpayer, the dutiable value of such goods shall be examined and determined in accordance with the other methods. 4) The dutiable value determined by other methods shall be applied in sequence. The exception is that after the taxpayers provide relevant information to the Customs, the taxpayers may request to reverse the sequence of application of chargeback price valuation method and computed price valuation method. (2) Valuation method using transacted price of identical goods The valuation method adopted by the Customs for examination and determination of the dutiable value of imports on the basis of the transacted price of identical goods sold to the People’s Republic of China at the time of importation or roughly around the same time “Identical goods” shall mean goods produced in the same country or region as the imports and identical in physical nature, quality, and reputation, etc, save for superficial minute variance. “Around the same time” shall mean a period of 45 days before and after acceptance by the Customs of the declaration for the goods. (3) Valuation method using transacted price of similar goods The valuation method using transacted price of similar goods shall mean the valuation method adopted by the Customs for examination and determination of the dutiable value of imports on the basis of the transacted price of similar goods sold to the People’s Republic of China at the time of importation or roughly around the same time. “Similar goods” shall mean goods produced in the same country or region as the imports and although not identical in all aspects, having similar features, similar composition materials, and identical functions, and being commercially exchangeable goods. (4) Chargeback price valuation method The chargeback price valuation method shall mean the valuation method adopted by the Customs for examination and determination of the dutiable value of imports on the basis of the selling price of the imports or identical or similar imports in China less the relevant expenses incurred in China; the selling price shall satisfy the following criteria simultaneously:

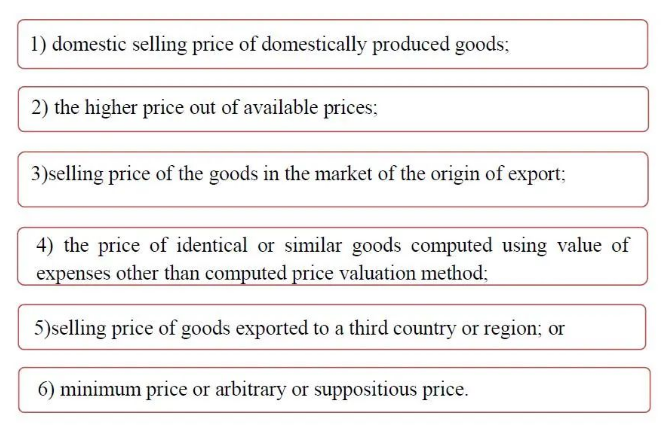

Note: Where the dutiable value of imported goods is examined and determined in accordance with the valuation method using transacted price of identical goods , “around the same time” shall mean a period of 45 days before and after acceptance by the Customs of the declaration for the goods. Where the dutiable value of imports is examined and determined in accordance with the chargeback price method and if the imports or identical or similar goods are not sold in China within 45 days before and after acceptance by the Customs of the declaration for the goods, the period of domestic sale may be extended up to within 90 days before and after acceptance of the declaration for the goods. (5) Computed price valuation method The Customs examine and determine the dutiable value of imports based on the aggregate of the following items: 1) material costs and processing fees incurred for manufacturing of such goods; 2) normal profits and general expenses (including direct expenses and indirect expenses) for selling goods of same grade or type in China; and 3) transportation and related expenses, and insurance premium prior to the unloading of such goods following the arrival in China. (6) Reasonable method Reasonable method shall mean the valuation method adopted by the Customs for examination and determination of the dutiable value of imports based on objective and quantifiable data in accordance with the principles of objectiveness, fairness and unity when the Customs is unable to adopt the aforementioned valuation method for determination of dutiable value. The Customs shall not use the following prices when adopting the reasonable method to determine the dutiable value of imports:

2. Dutiable Value of Exports The dutiable value of exports shall be examined and determined by the Customs based on the transacted price of the goods, and shall include the transportation and related expenses and insurance premium of the goods prior to loading before transportation to the place of exit in the People's Republic of China. Where the transacted price of exports cannot be determined, the Customs shall, upon investigation of the status and price negotiation with the taxpayer, examine and determine the dutiable value of such goods in the following sequence: (1) the transacted price of identical goods at the time of exportation to the same country or region at the time of exportation or roughly around the same time; (2) the transacted price of similar goods at the time of exportation to the same country or region or roughly around the same time; (3) the price computed on the basis of the costs, profits and general expenses (including direct expenses and indirect expenses) incurred for producing identical or similar goods in China, transportation and related expenses, and insurance premium incurred in China; and; (4) a price determined in accordance with a reasonable method. (III) Main Procedures 1.To examine whether the taxpayer truthfully declares the price to Customs, and provide invoice, contract, bill of lading, packing list, and other documents. 2. If required by Customs, whether the taxpayer provide proof of payment in relation to the transaction of the goods and other commercial documents, written materials and electronic data to prove that the price declared is true and accurate. Under the circumstances required by Customs, such as the goods involving price adjustment, or the transportation and related expenses stated in the methods for determination of dutiable value, Customs has doubts about whether the taxpayer has truthfully declared the goods. In this case, the Customs will examine the price of the goods and confirm whether the relevant circumstances affect the transacted price. 3. In order to determine the completeness and accuracy of the declaration contents, Customs may require the taxpayer and Customs declaration enterprise to make supplementary declaration, for example, to provide further proof of payment in relation to the transaction of the goods and other commercial documents, written materials and electronic data to prove that the price declared is true and accurate. 4. Where the Customs has doubts over the truthfulness or accuracy of a declared price or is in the opinion that the special relationship between the buyer and the seller has an impact on the transacted price, the Customs shall initiate Price Query Negotiation Procedure and notify the taxpayer in writing of the reason for query. The taxpayer shall provide the relevant materials or other evidence in writing to prove that the declared price is truthful and accurate or that the special relationship between the buyer and the seller has no impact on the transacted price. 5. Upon verification of the relevant materials and evidence provided by the taxpayer, the Customs has reason to doubt the truthfulness and accuracy of the declared price; Or the Customs has reason to believe that the special relationship between the buyer and the seller has an impact on the transacted price, Customs shall not accept the declared price and shall, in accordance with relevant provisions, use the other valuation methods mentioned above in turn to examine and determine the dutiable value. On the contrary, Customs accept the declared price of the enterprise as the transacted price to determine the dutiable value.

II. Key points and measures of Customs price check

The existing laws and regulations confer on Customs corresponding powers to ensure the performance of duties. The main procedures for price determination introduced in the preceding paragraphs have involved part of Customs powers and duties in the field of price determination. For example, Customs has the right to doubt the declared price, request explanation and supplementary materials, conduct price negotiation, etc. In addition, Customs may conduct price check, price inspection, and where illegal acts have been found, transfer the case to the anti-smuggling department for investigation and criminal investigation. This part will make a brief introduction to price check of Customs, and price inspection will be introduced in the following notes. (I) Main Points for Price check Price check is one of the areas that Customs pays attention to. It shall mean the duties performed by the Customs for determination of the dutiable value of imports and exports in accordance with the law, examination of documents, data verification, inspection of physical goods and the relevant account books, etc, and examination of the truthfulness and accuracy of transacted prices of imports and exports declared and whether there is a special relationship between the buyer and the seller which has an impact on the transacted price; During price check, Customs actually conducts a comprehensive and systematic review and verification of the actual trade and transaction of the imports and exports. The key contents of price check are as follows:

Item 2, “relevant expenses” here, such as royalties, the “assistance” expenses provided by the buyer free of charge or at a reduced price, freight and insurance premiums incurred abroad, commissions and brokerages other than the commission for buying the goods, expenses for the containers which are considered integral parts of the imported goods, expenses related to packaging materials and packing services, proceeds from resale, disposal or use of imported goods by the seller, etc. Whether there are special arrangements in the transaction that affect the transacted price, such as whether there is a tie-in, mutual sale, etc. (II) Main Methods for Price Check 1.Price check is mainly conducted though the methods of inspecting documents, verifying data, and checking goods and relevant accounts. The key methods for price check are as follows, (1) inspect or make copies of contracts, invoices, account books, proof of purchase and settlement of foreign exchange, documents, business correspondence, audio and video recordings and other commercial documents, written materials, and electronic data which indicate the relationship between the buyer and the seller and the transactions in relation to the exports;; (2) investigate into taxpayers engaging in importation and exportation and citizens, legal persons, or other organisations who/which have financial dealings or other business dealings with the taxpayers, and investigate issues relating to the import and export prices; (3) inspect imports and exports or take samples for inspection or laboratory testing; (4) enter the production and business premises of the taxpayers or storage premises of goods to inspect goods relating to importation and exportation activities and the status of production and business; (5) upon approval by the director-general of the direct superior Customs or the director-general of the authorised subordinate Customs, the Customs may investigate into the financial dealings of the taxpayers in corporate accounts maintained with banks or other financial institutions and report to the banking regulatory authorities accordingly; or (6) make enquiry with tax authorities on the status of tax payment in relation to the imports and exports in China. 2. According to price check, Customs may also determine whether to initiate the procedure of inspection, investigation and even criminal detection to verify the import and export goods and activities of enterprises, so as to verify whether the import and export activities of enterprises conform to Customs laws and regulations.

III. The legal liability and compliance suggestions for enterprises

(I) Legal Liability Where an enterprise fails to truthfully declare the value, falsely conceals the value, evades taxes, etc. which, upon examination and determination by Customs, constitute acts in violation of the Customs supervision regulations or smuggling acts, Customs shall punish in accordance with the Implementation Regulations of the Customs of the People’s Republic of China on Administrative Penalties, where the case constitutes a criminal offence, criminal liability shall be pursued in accordance with the law. Note: When the consignee or consignor of imports or exports entrusts a third party in China to handle the Customs clearance and logistics business for them, they need to provide the third party with the relevant documentary information (including price information) of imported goods or exported goods truthfully, accurately and completely, otherwise they may bear the corresponding legal liabilities (see Extension of Knowledge).

Extension of knowledge Pursuant to Article 12 of Administrative Provisions of the Customs of the People's Republic of China on the Declaration of Imports and Exports: Where a Customs declaration enterprise accepts the entrustment by a consignee or consignor of imports or exports to complete Customs declaration formalities, it shall enter into an entrustment agreement with the consignee or consignor of imports or exports for the specific entrusted matter, and the consignee or consignor of imports or exports shall provide true information of the Customs declaration matter to the Customs declaration enterprise. Pursuant to Article 15 of Implementing Regulations of the Customs of the People's Republic of China on Administrative Penalties: Persons who fail to make declaration or truthful declaration to the Customs of the descriptions, tariff numbers, quantities, specifications, prices, trading mode, place of origin, place of departure, place of consignment and final destination of imports and exports or other declarable items shall be punished in accordance with the following provisions and illegal income shall be confiscated: (1) where the accuracy of Customs statistics is compromised, the offender shall be given a warning or subject to a fine ranging from RMB1,000 to RMB10,000; (2) where the order of Customs supervision is compromised, the offender shall be given a warning or be subject to a fine ranging from RMB1,000 to RMB30,000; (3) where the administration of State permits is compromised, a fine ranging from 5% to 30% of the value of the goods shall be imposed; (4) where the collection of State taxes is compromised, a fine ranging from 30% to 200% of the evaded tax amount shall be imposed; and (5) where foreign exchange administration and administration of export tax refund are compromised, a fine ranging from 10% to 50% of the declared price shall be imposed. Pursuant to Article 16 of Implementing Regulations of the Customs of the People's Republic of China on Administrative Penalties: Where the consignee and consignor fail to provide accurate Customs declaration information as entrusted by their principal to the Customs declaration enterprise and thus resulting in any of the occurrences stipulated in Article 15 of the Regulations, the principal shall be punished in accordance with the provisions of Article 15.

(II) Compliance Suggestions

1.The premise of compliance management is that the enterprise shall have a clear and accurate understanding about the “rules” to be observed in business operation from the subjective intend to the objective reality. Specifically in the area of Customs value, enterprises need to learn about and master relevant regulations and requirements for the determination of Customs value and price declaration, and then, truthfully, accurately and completely declare the price of goods in importing and exporting activities. 2. Determination of Customs value is highly professional and complex, inevitably leading to confusion and problems among enterprises. At this time, enterprise may wish to borrow external resources to solve problems efficiently. For example, before the import and export of goods, enterprises may apply to Customs for preliminary ruling of prices; when faced with Customs challenge on price or found that there may be a risk of Customs price check, enterprises may invite lawyers to intervene in a timely manner in order to take full advantage of policy provisions such as price negotiation and proactive disclosure to take the initiative and stop losses and mitigate damages. 3. It’s necessary for enterprises to continue to complete their internal compliance system, so as to prevent and defuse regulatory risks through carrying out regular or targeted internal compliance self-inspections. In addition, it’s necessary to strengthen the compliance supervision against a third party partner in order to avoid the legal risks caused by the illegal acts of the third party.

Conclusion

Determination of the value of imports and exports is an important issue for both enterprises and Customs. For enterprises, truthful, accurate and complete declaration of the price of imports and exports to Customs is not only a legal obligation and compliance requirement but also the cornerstone to enjoy policy dividends and improve comprehensive competitiveness. For Customs, it is one of its statutory duties to supervise enterprises to truthfully declare prices, examine and determine the dutiable value of imports and exports, and ensure that the tax is collected in full. The existing laws and regulations confer to Customs powers so as to examine and determine the dutiable value of imports and exports. For example, Customs has the right to challenge the declared price and carry out price negotiation; it may conduct price check and inspection; and, where there are suspected violations of the laws, the case may be transferred to the anti-smuggling department for administrative investigation or criminal investigation, once violations are found and determined, the enterprise shall bear the corresponding legal liabilities. The price issue has become a high risks area of compliance for import and export enterprises, which is related to the highly professional and technical nature, the complexity of international trade, and the fact that enterprises do not understand Customs price check regulations and other factors. Based on this, this notes give a brief introduction to Customs price determination and price check, and put forward compliance suggestions for enterprises’ reference.

(Original article, reprint please mark the author and source)