Customs Inspection of Special Relationship and Transfer Pricing

Author: Sean Jia & Ning Jing 2023-02-09[Abstract] The special relationship and the transfer pricing are the price factors that are the concern of Customs to determine the dutiable value, and are the places where multinational companies often encounter difficulties in the price declaration of imported goods. In particular, since March 2016, Customs has made it clear from legislation that enterprises need to take the initiative to confirm special relationship, price impact, and payment of royalties when declaring imported goods. On the one hand, such provisions increase the voluntary declaration obligation of enterprises in terms of price information, on the other hand, they also provide evidence support for the Customs’ follow-up investigation on whether there is a subjective intention of price concealing, and whether it constitutes smuggling or illegal acts. Therefore, it is necessary for enterprises to master the provisions of the Customs determination of dutiable value on special relationship and transfer pricing, so as to effectively respond to the queries raised by Customs and timely address the compliance risks.

[Keywords] Customs determination of dutiable value, special relationship, transfer pricing, compliance suggestions

I. The special relationship and transfer pricing in Customs determination of dutiable value

(I) Special relationship 1. Circumstances constituting special relationship in Customs determination of dutiable value According to Article 16 of the Measures of the PRC Customs on Determination of Dutiable Value for Imports and Exports, the main circumstances that constitute special relationship in Customs determination of dutiable value: (1) the buyer and the seller are family members; (2) the buyer and the seller are senior management personnel or directors; (3) one party is directly or indirectly controlled by the other party; (4) both the buyer and the seller are directly or indirectly controlled by a third party; (5) the buyer and the seller have joint control over a third party directly or indirectly; (6) either party owns, controls or holds 5% or more (inclusive of 5%) of the voting shares of the other party directly or indirectly; (7) one party is an employee, a senior management personnel, or a director of the other party; or (8) the buyer and the seller are both members of a partnership. Where the buyer and the seller are related in business or one party is the sole agent, sole distributor, or sole transferee of the other party and satisfy the provisions of the preceding paragraph(s), they shall be deemed to have a special relationship. 2. Should the enterprise be very concerned if there is special relationship in the transaction?

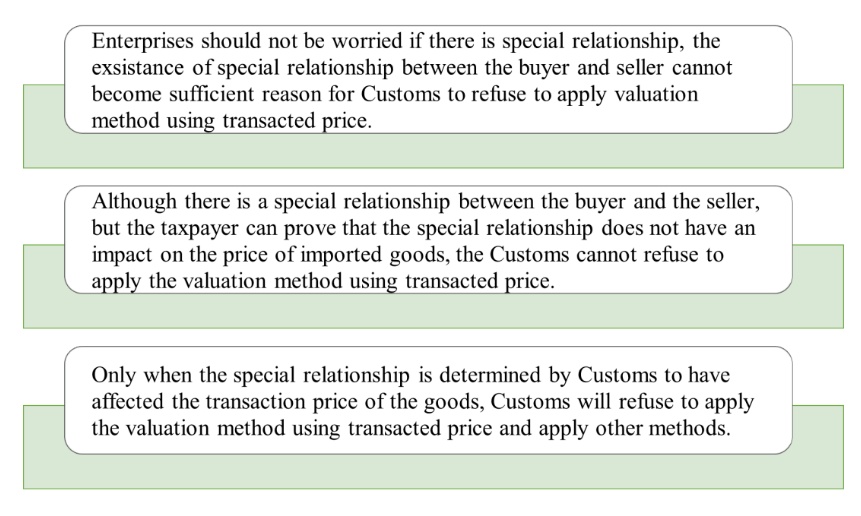

Enterprise can prove that the special relationship did not have an impact on the transacted price in the following two ways. (1) Provide test price Test price provided to Customs include: the transacted price of identical or similar imports sold to a buyer in China which does not have a special relationship with the seller; the dutiable value of identical or similar imports determined in accordance with the chargeback price valuation method; the transacted price of identical or similar imports determined in accordance with the computed price valuation method. In other words, even if there is a special relationship between the buyer and the seller, it shall be deemed that the special relationship has no effect on the transacted price of the imports provided that the taxpayer can prove that the transacted price is similar to any of the above-mentioned prices occurring at or about the same time. Attorney’s reminder When making a comparison using the aforesaid price(s), the Customs shall consider the difference in commercial standards and import quantities, as well as whether the variance in costs is affected by the buyer and the seller having special relationship. (2) The sales environment test The sales environment test means that the Customs’ determination of whether the special relationship affects the transacted price, it usually inspects the sales environment of both sides of the transaction, requiring enterprises to provide information on how the invoice or contract price is reached, whether the declared price conforms to the normal pricing practices of the industry, whether it conforms to the sales price to the third party without special relationship, whether the profit conforms to the level of similar goods, etc. Enterprises need to seize the opportunity to take the initiative to provide Customs with information that can prove that the declared price is fair and reasonable. Once these materials are accepted by Customs, it can be determined that the special relationship does not have an impact on the transacted price of the imports. Attorney’s Summary Existence of special relationship ≠ Rejection of valuation method using transacted price The declared price can be proved to be fair and reasonable by providing test price or sales environment test. (II) transfer pricing 1. The meaning of the transfer pricing The transfer pricing refers to the pricing used in the supply of products, services or technologies between parent companies and subsidiaries, and between subsidiaries within multinational companies. It is a means of international capital management often used by multinational companies to avoid political and tax barriers set by some host countries and reduce the cost of foreign exchange transactions. 2. Transfer pricing and the special relationship Transfer pricing is closely related to special relationship (Related transactions). Affiliated enterprises may establish or attach conditions to their mutual commercial or financial relationships that differ from those between independent enterprises, thereby violating the principle of independent competition and affecting the fairness and reasonableness of the transaction. It is based on the pricing method of related transactions and the tax risks that may arise. Therefore, whether the special relationship between affiliated enterprises affects the transacted price (including whether the transfer pricing policy is fair and reasonable) is the focus of Customs price inspection. In a word, transfer pricing is related to the fairness and reasonableness of prices in connected related transactions and is also an important aspect for Customs to determine whether the special relationship between multinational companies has affected the declared price.

II. Common enforcement used in Customs determination of special relationship and transfer pricing

(I) Customs may require enterprises to submit the following materials 1. Annual financial and accounting statements and audit reports for the past 3 years. 2. Imports situation, including the names, specifications, and price lists of imported goods, lists of suppliers, etc. 3. The list of affiliated enterprises and the relationship among affiliated enterprises, including the organizational structure of multinational companies, the division of labor among affiliated enterprises, etc. 4. Transactions with affiliated enterprises, including the purchase and sale, transfer, and use of tangible and intangible property, financing, and provision of labor services, etc. 5. Pricing policies of affiliated enterprises, including purchase pricing, sales pricing policies. 6. The internal control status of the affiliated enterprises under review, including the internal control system and accounting system of the affiliated enterprises, etc. If the pricing strategy of the affiliated enterprises under review include price adjustment factors, Customs may require the affiliated enterprise under review to provide relevant materials to prove the authenticity and reasonableness of the pricing policy chosen. (II) The Customs may exercise the authority to carry out price inspection The Customs may exercise the authority to carry out price inspection to examine the validity and accuracy of declared prices: (1) check and make copies of the contracts, invoices, accounts, exchange settlement vouchers, shipping documents, business correspondence, audio and video tapes and other documents which reflects the relationship and trading activities between the buyer and seller; (2) investigate issues related to the price of imports and exports with taxpayers and citizens, legal persons or other organizations with whom they have financial or other business dealings; (3) inspect imports and exports or take samples for inspection or testing; (4) enter the production and business premises of the taxpayers or storage premises of goods to inspect goods relating to importation and exportation activities and the status of production and business; (5) subject to the approval of the Director of the Customs office or the Director of an authorized subordinate Customs office, the Customs may investigate into fund transactions of the bank accounts of the taxpayer with a bank or financial institution by presenting the “Notice of the General Administration of Customs on Assistance to Bank Account Enquiries” and ID cards of the relevant personnel and investigation findings shall be reported to the banking regulatory authorities (6) make inquiries with tax authorities for the payments of domestic taxes in relation to the imports and exports. Attorney’s reminder 1.For price issues, in addition to price inspection, Customs can also carry out special inspections for price issues according to the situation, if it is found that there may be illegal or irregular conduct, it will be further transferred to the anti-smuggling department for investigation. 2. For the examination of price issues, the Customs price inspection, special inspection, case investigation applicable legal provisions, law enforcement procedures are different. As the subject of inspection, the response and liability risk are also different, so when Customs starts relevant enforcement procedures, it is recommended that enterprises seek assistance from lawyers in time.

III. The difference between Customs inspection and Taxation inspection and compliance suggestions.

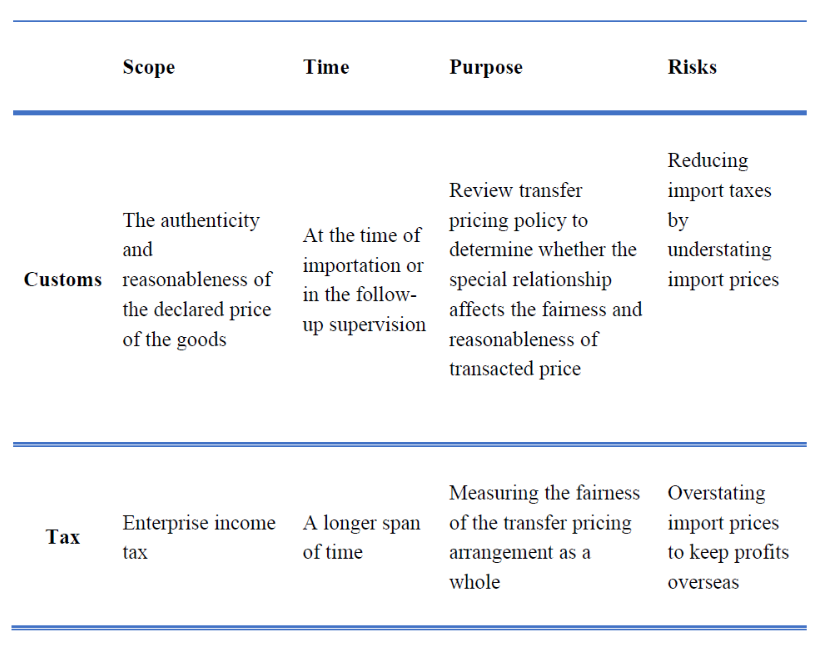

(I) The difference between the Customs inspection and Taxation inspection Although both Customs and tax are concerned with the fairness of transfer pricing policies of multinational groups, because of the different divisions of functions, there are significant differences in the focus of the two departments and the methods of price valuation. 1. The different focus

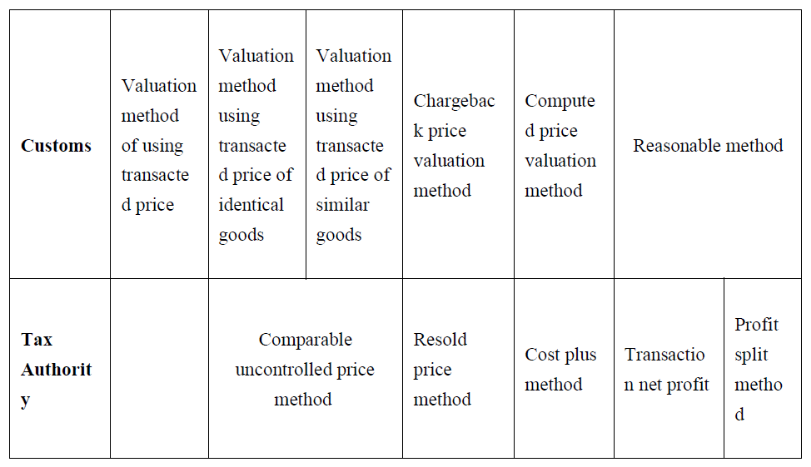

2. The determination of dutiable value

Notes: (1) There is no requirement for the order of application of taxation valuation methods, while Customs valuation methods have the order of application, which are applied successively in principle. And only when the previous order of valuation methods cannot be applied, the next order of valuation methods will be applied. The exception is the computed price valuation method and the reasonable method, which can be reversed after the application of the enterprise and the consent of the Customs. (2) To better understand, we have listed and compared the valuation methods of the two departments in a table, but it does not mean that the valuation methods of the comparison have legal overlap. When the enterprises apply and understand each specific valuation method, they still need to comply with the respective legal provisions and requirements of the Customs and tax authority. (II) Compliance suggestions for enterprises Many enterprises think that Customs and tax authority are concerned about the fairness and reasonableness of transfer pricing, so that when dealing with Customs price inspection, they submit the transfer pricing report submitted to tax authority in its original form, however, they find that the persuasive effect is not satisfactory. Even because they do not prevent the risk of compliance from the perspective of Customs valuation, it plays a negative role instead. So, how should enterprises deal with Customs inspection on transfer pricing? 1.From a overall perspective, the regulatory requirements of Customs and tax authority should be coordinated in advance, and the transaction arrangements and transfer pricing policies should be formulated in a manner that meets the price inspection requirements of the tax authorities, while reflecting the fairness of the related transactions from the perspective of Customs valuation and price inspection. 2. In daily planning and operation, enterprise also need to accumulate and organize information that proves the fairness and reasonableness of their pricing strategies for inspection. 3. The transfer pricing report can be used to support the fairness of the price. Due to the different functions of Customs and tax authorities, it is difficult to give the transfer pricing report to Customs as it is. Enterprises need to change their thinking, organize and provide information from the perspective of Customs, and provide explanations in a timely manner for the Customs’ doubts. Only in this way can the the transfer pricing report play its role in supporting the fairness and reasonableness of the declared price. 4. Similarly, Customs collection and management practices should also be taken into account when submitting other price information to Customs, so as to explain the fairness and reasonableness of the declared prices from the perspective of Customs price inspection. In addition, the evidence submitted should be able to corroborate and support each other to avoid self-contradictory situations. 5. Consult or invite attorneys to intervene in time to determine the problem and the corresponding risks, take countermeasures to prevent the problem from escalating due to untimely response, or miss the best stop loss point.

Conclusion

In recent years, Customs increased the inspection of special relationship and other price elements, especially since March 2016, Customs has made it clear from legal provisions that enterprises have the obligation to proactively confirm the special relationship and other price elements when declaring the price of imported goods. If the enterprises do not take the initiative to fulfill the obligation to declare or improperly performed, they will need to bear the corresponding legal liability accordingly. In practice, we found that many enterprises have misunderstandings in their response to the special relationship and transfer pricing inspection. And they submit the transfer pricing report submitted to tax authority in its original form, however, they find that the persuasive effect is not satisfactory. Even because they do not prevent the risk of compliance from the perspective of Customs valuation, it plays a negative role instead. In conclusion, this note provides a brief introduction to the provisions of Customs inspection on special relationship and transfer pricing for the reference of enterprises.

Reference: [1]: 360 baike: https://baike.so.com/doc/5921702-6134622.html