Three Questions of Valuation Method Using Transacted Price

Author: Sean Jia, Jing Ning 2022-11-03Overview

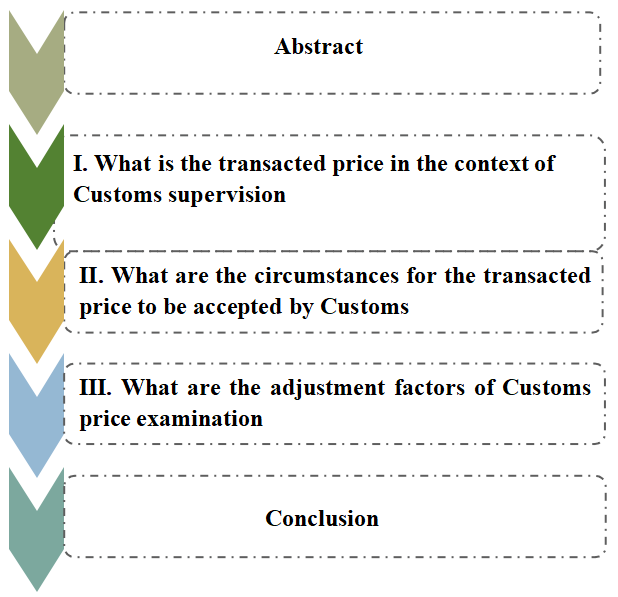

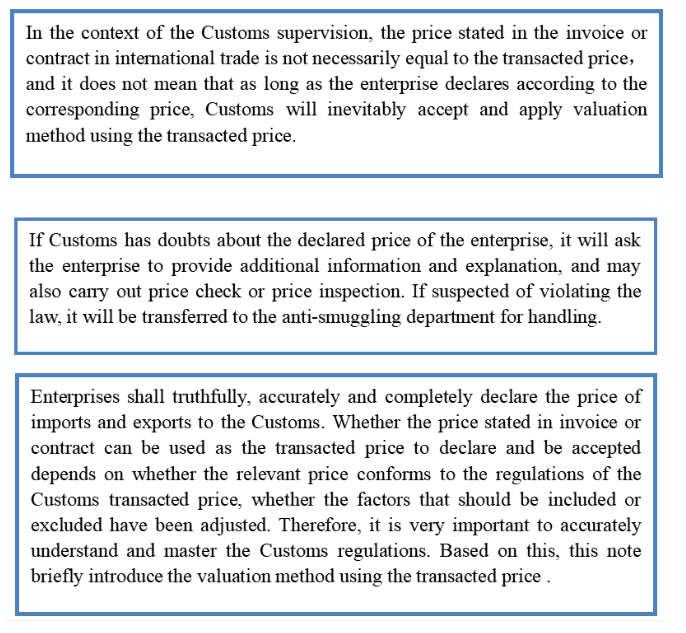

Abstract: I used the invoice price to declare the price of the import and export goods to the Customs , isn’t invoice price the transacted price? Why does the Customs still query and check the price I declared? Isn't the transacted price method the priority when Customs determine the price? This confusion often occurred in practice, which is actually a misunderstanding of the Customs valuation method using transacted price. The note will help you accurately understand the Customs valuation method using transacted price through three questions: 1. What is the transacted price in the context of Customs supervision? 2. What are the circumstances for the transacted price to be accepted by Customs? 3. Which factors should be included in the transacted price and which factors should be deducted when Customs determine the price? Keywords: Customs Price determination, Transacted Price, Adjustment factors In the case of Customs duties ad valorem, valuation method using transacted price is the first method to be applied by the Customs to determine the dutiable value, but the transacted price in the context of the Customs is not necessarily equal to the price stated in invoice or contract in international trade. Only when the price stated in the invoice or contract declared by enterprises conforms to the provisions of the Measures of the PRC Customs on Determination of Dutiable Value for Imports and Exports (hereinafter referred to as the “Price Determination Measures”), the declared price may be accepted by Customs and used as the transacted price to determine the dutiable value of import and export goods. Considering that most goods are not tax-related when exported, and the regulations on the dutiable value of exported goods are relatively simple, the following takes imported goods as an example to introduce.

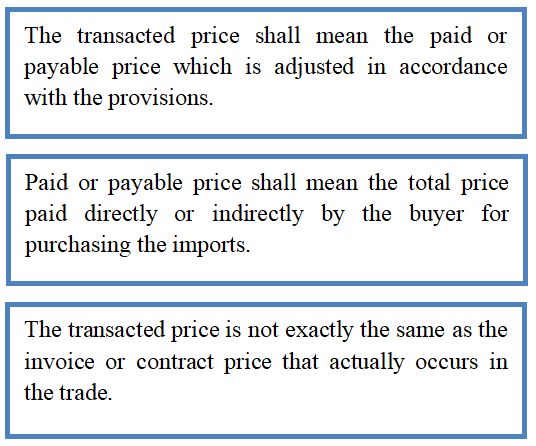

Ⅰ. What is the transacted price in the context of Customs supervision (I) The transacted price of imported goods shall mean the total amount of actual payment made by the buyer or payable to the seller which is adjusted in accordance with the provisions of Price Determination Measures for such imports at the time of sale of such goods by the seller within China, including amounts paid directly and indirectly. (II) Analysis of key points

1. The transacted price shall mean the paid or payable price which is adjusted in accordance with the provisions The transacted price in the Customs price determination has a specific meaning. It must be the paid or payable price adjusted according to the “Price Determination Measures”, and at the same time it must meet certain conditions. 2. The paid or payable price The form of payment can be direct payment or indirect payment. 3. The transacted price is not exactly the same as the invoice or contract price that actually occurs in the trade It should be noted that the price in invoice or contract in trade is often agreed by the buyer and the seller, and the agreed price may be the paid or payable price, or it may also include the transportation and related expenses and insurance premium of the goods prior to unloading at the place of arrival of the goods in the People’s Republic of China, or may even include other factors that need to be adjusted.

Ⅱ. What are the circumstances for the transacted price to be accepted by Customs

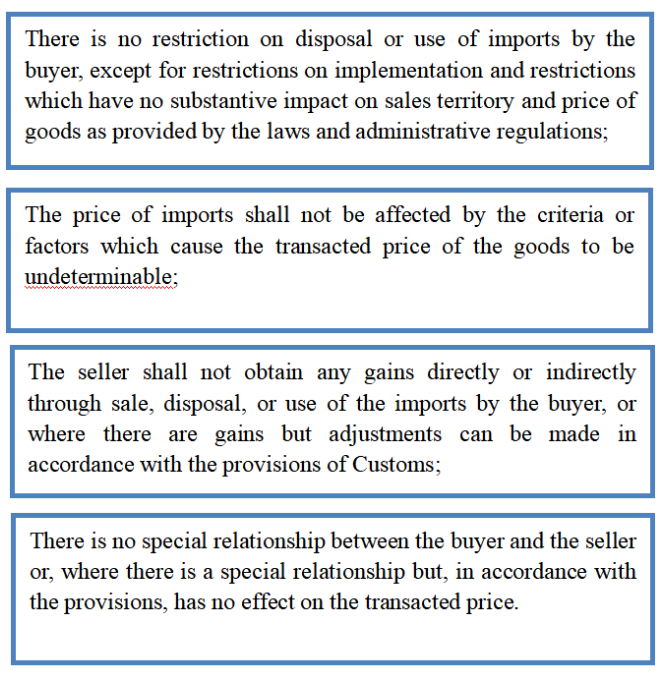

According to provisions of the “Price Determination Measures”,the transacted price of imports shall satisfy the following criteria shown in the picture. We will interpret them as follows:

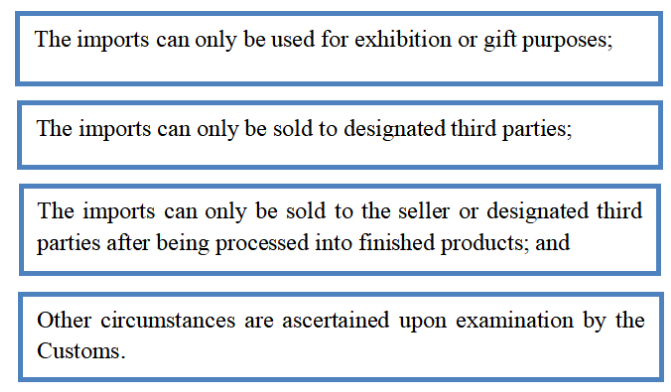

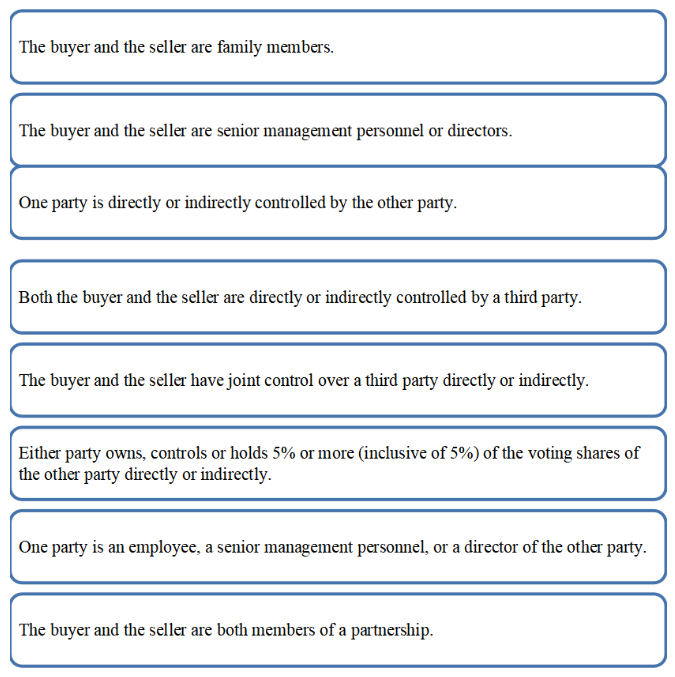

(Ⅰ) There is no restriction on disposal or use of imports by the buyer The criteria should be set based on the requirement that the transaction be fair. If a transaction is based on a restriction, the price may be affected and therefore the valuation method using transacted price is not applicable. We think that the restrictions here shall not be interpreted broadly, it is more appropriate to understand the restrictions that have substantive impact on the price. Then, what are the restrictions on disposal or use of imports by the buyer? The “Price Determination Measures” made enumerative provisions for this (as shown in the figure): (II) The price of imports shall not be affected by the criteria or factors which cause the transacted price of the goods to be undeterminable. The circumstances or factors mentioned here could be understood in conjunction with the Article 10 of the “Price Determination Measures”. This article stipulates that Under any of the following circumstances, the price of imports shall be deemed to have been affected by the criteria or factors which cause the transacted price of the goods to be undeterminable: (1) the price of imports is determined in accordance with the criterion that the buyer shall purchase a certain quantity of other goods from the seller; (2) the price of imports is determined in accordance with the criterion that the buyer shall sell other goods to the seller; and (3) it is ascertained upon examination by the Customs that the price of the goods is affected by the criteria or factors which cause the transacted price of the goods to be undeterminable. The aforementioned (1) is what we usually call tie-in sales, that is, the seller’s sales price depends on the buyer purchasing a specific quantity of other goods at the same time. Once such a circumstance is found, Customs will consider that the sales or price is affected by certain criteria or factors, therefore, the valuation method using transacted price is rejected . (III) The seller shall not obtain any gains directly or indirectly through sale, disposal, or use of the imports by the buyer, or where there are gains but adjustments can be made in accordance with the “Price Determination Measures”. According to paragraph 1(4) of article 11 of “Price Determination Measures”, when the dutiable value of imports is examined and determined on the basis of the transacted price, the following expenses or value which have not been included in the actual price or payable price of the goods shall be included in the dutiable value: gains derived by the seller directly or indirectly from the buyer’s income from sale, disposal, or usage of such goods following importation. In practice, there is a buyer who, in addition to paying the price of the goods, returns part of the resale and use profits of the imports. In this circumstance, if there is no objective and quantitative data, adjustments cannot be made in accordance with the “Price Determination Measures”. Customs can refuse to use the valuation method using transacted price. (IV) There is no special relationship between the buyer and the seller or, where there is a special relationship but, in accordance with the provisions has no effect on the transacted price. There are two questions involved here: first, what is special relationship? Second, how to determine whether the special relationship has affected the price in invoice or contract between the two parties? · What is special relationship? According to the Article 16 of the “Price Determination Measures”, under any of the following circumstances, the buyer and the seller shall be deemed to have a special relationship: Where the buyer and the seller are related in business or one party is the sole agent, sole distributor, or sole transferee of the other party and satisfy the provisions of the preceding paragraph(s), they shall be deemed to have a special relationship. · How to determine whether the special relationship has effect on the price in the invoice or contract between the two parties? According to the Article 17 of the “Price Determination Measures”, where there is a special relationship between the buyer and the seller but the taxpayer is able to prove that the transacted price is close to any of the following prices at the same time or roughly around the same time, the special relationship shall be deemed to have no effect on the transacted price of the imports: (I) the transacted price of identical or similar imports sold to a buyer in China which does not have a special relationship with the seller; (II) the dutiable value of identical or similar imports determined in accordance with the provisions of chargeback price valuation method; or (III) the dutiable value of identical or similar imports determined in accordance with the provisions of computed price valuation method. When making a comparison using the aforesaid price(s), the Customs shall consider the difference in commercial standards and import quantities, as well as whether the variance in costs is affected by the buyer and the seller having a special relationship. If, upon examination of the circumstances relating to the sale of the goods, Customs deems it to be in conformity with general commercial practices, it may determine that the special relationship has no effect on the transacted price of the imports.

Ⅲ. What are the adjustment factors of the transacted price?

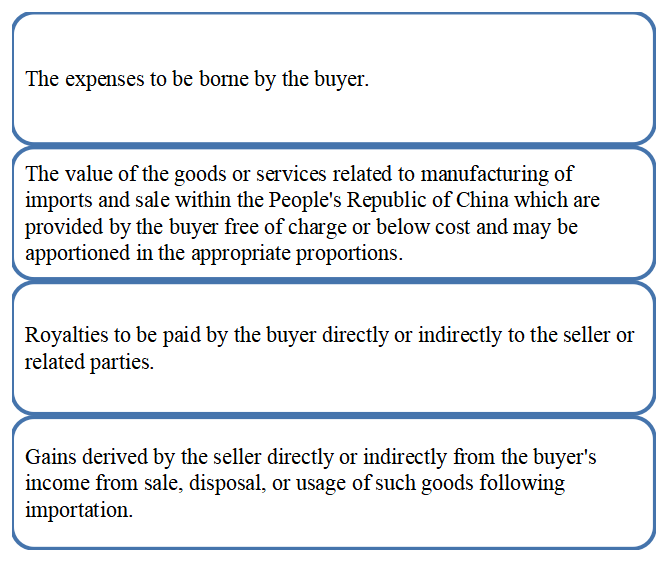

According to the “Price Determination Measures”, when determining the dutiable value, the Customs shall, on the basis of the paid or payable price declared , add the factors that should be included and subtract the factors that should not be included. the final adjusted price is the transacted price. In short, the aforementioned factors that shall be included in the transacted price and the factors excluded from the transacted price are the adjustment factors, the former is called the addition term, the latter is the subtraction term. (Ⅰ) Addition Term: The factors that shall be included in the transacted price According to the Article 11 of the “Price Determination Measures”, when the dutiable value of imports is examined and determined on the basis of the transacted price, the following expenses or value which have not been included in the actual price or payable price of the goods shall be included in the dutiable value:

· The following expenses to be borne by the buyer: (1) commission and broker’s fee other than commission for procurement; (2) expenses of containers deemed to be part of the goods; and (3) packaging material costs and packaging labour costs; · The value of the following goods or services related to manufacturing of imports and sale within the People’s Republic of China which are provided by the buyer free of charge or below cost and may be apportioned in the appropriate proportions: (1) materials, components, parts, and similar goods included in the imports; (2) tools, models, and similar goods used in the process of manufacturing of the imports; (3) materials consumed in the process of manufacturing of the imports; and (4) engineering design, technical research and development, craft, drafting, and related services required for manufacturing of the imports overseas · Royalties to be paid by the buyer directly or indirectly to the seller or related parties, except for those paid under any of the following circumstances: (1) the royalties are not related to such goods; or (2) payment of royalties shall not constitute a criterion for sale of such goods within the People’s Republic of China; and · Gains derived by the seller directly or indirectly from the buyer’s income from sale, disposal, or usage of such goods following importation. Taxpayers shall provide the Customs with objective and quantifiable data on the aforesaid costs or values. If taxpayer is unable to provide, the Customs shall, upon clarifying the relevant information and carrying out price negotiation with the taxpayer, the dutiable value of such goods shall be examined and determined in accordance with the following methods of using transacted price of identical goods, using transacted price of similar goods, chargeback price, computed price; and reasonable. (Ⅱ) Subtraction Term: The factors not included in the dutiable price According to the Article 15 of the“Price Determination Measures”, the following taxes and expenses listed individually in the price of the imports shall not be included in the dutiable value of such goods: 1. construction, installation, assembly, maintenance, or technical support expenses of plant, machinery, or equipment, etc, incurred following importation, with the exception of repair expenses; 2. transportation and related expenses and insurance premium incurred after unloading of the imports upon arrival in the People’s Republic of China; 3. import tariff, import-linked taxes levied by the Customs and other domestic taxes; 4. fees paid for duplication of the imports in China; and 5. expenses incurred for technical training and overseas observation, and study in China and overseas. 6. Interest expenses which satisfy the following criteria simultaneously shall not be included in the dutiable value: (1) the interest expenses incurred for financing the purchase of the imports; (2) there is a financing agreement in writing; (3) the interest expenses are listed out individually; or (4) the taxpayer can prove that the interest rate is not higher than the normal interest rate for financing such transactions in the locality at the same time and the actual paid or payable price of imports is very close to that of identical or similar imports where there is no financing arrangement.

Conclusion

(Original article, reprint please indicate the authors and source)