Other Customs Valuation Methods for Imported Goods

Author: Sean Jia & Jing Ning 2023-01-10[Abstract] It is said that the valuation method using transacted price is usually preferred by Customs in examining and determining the dutiable value of the imports. So if the transacted price cannot be determined, or the transacted price does not meet the conditions, or there is no transacted price, how should Customs determine the dutiable value?

The aforementioned issue involves other Customs valuation methods.

What are the other Customs valuation methods and its key points?

The notes will give a brief introduction.

[Keywords] Customs valuation, other methods, basic points

Although the valuation method using transacted price is the most frequently used one in Customs examining and determining the dutiable value of the imports and exports, in view of the actual complexity of trade, the valuation method using transacted price is often not applicable. Therefore, it is necessary to use other Customs valuation methods. This notes will take imported goods as an example to briefly introduce other Customs valuation methods.

I. Overview of Other Custom Valuation Methods of Imports

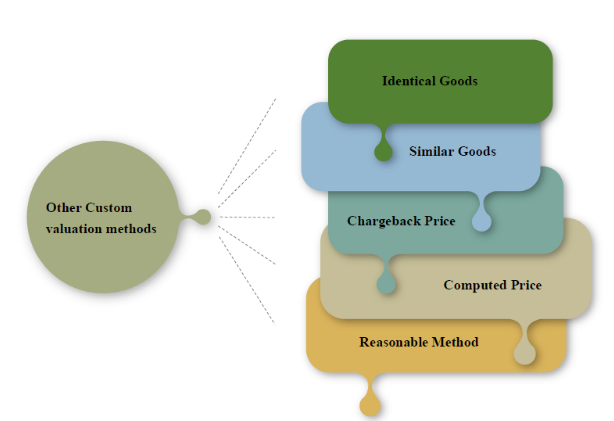

According to the Articles 19 to Article 27 of the Measures of the PRC Customs on Determination of Dutiable Value for Imports and Exports (hereinafter referred to as “the Measures”), other valuation methods are as follows: valuation method using transacted price of identical goods, valuation method using transacted price of similar goods, chargeback price valuation method, computed price valuation method, and reasonable method (as shown in the graphic).

When applying to other valuation methods, enterprises should pay attention to: 1. Other valuation methods shall be considered only when the valuation method using transacted price cannot be applied. 2. The five types of methods shall be applied in a sequential order and can not be reversed at will. That is to say, the valuation methods of the previous order shall be applied first, and the valuation methods of the next order shall be applied only when the current order cannot be applied. 3. Exceptions for the sequential order of application. With the application of the taxpayer and the consent of the Customs, chargeback price valuation method, computed price valuation method can be reversed.

Ⅱ. Valuation method using transacted price of identical or similar goods

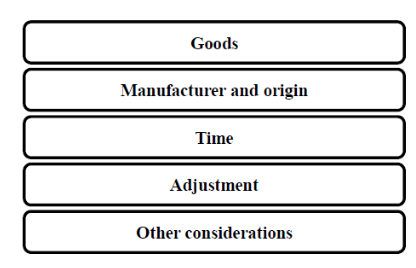

Valuation method using transacted price of identical goods and valuation method using transacted price of similar goods have the same application conditions except the difference of the goods themselves, so we put these two methods together to introduce. (Ⅰ) Definition The valuation method using transacted price of identical goods shall mean the valuation method adopted by the Customs for examination and determination of the dutiable value of imports on the basis of the transacted price of identical goods sold to the People's Republic of China at the time of importation or roughly around the same time. The valuation method using transacted price of similar goods shall mean the valuation method adopted by the Customs for examination and determination of the dutiable value of imports on the basis of the transacted price of similar goods sold to the People's Republic of China at the time of importation or roughly around the same time. (Ⅱ) Applicable conditions According to the transacted of price of identical or similar goods for examination and determination of the dutiable value of imports, the following five elements shall be considered at the same time.

1. Goods: the goods shall be identical or similar to the imports “Identical goods” shall mean goods produced in the same country or region as the imports and identical in physical nature, quality, and reputation, etc, save for superficial minute variance.

[Case 1]: Wallpapers imported by interior decorator and wholesale distributor respectively. Wallpapers, which are the same in all respects, are still deemed as identical goods even if they are imported by interior decorator and wholesale distributor respectively at different prices. Although different prices may indicate a difference in quality or reputation, and the difference in quality or reputation is a factor in determining whether the identical or similar goods are considered, the price itself is not a factor in determining the identical or similar goods.

“Similar goods” shall mean goods produced in the same country or region as the imports and although not identical in all aspects, having similar features, similar composition materials, and identical functions, and being commercially exchangeable goods. [Case 2]: Inner tubes of wheel imported from two different manufacturers. Rubber inner tubes are imported from two different manufacturers in the same country, and the size ranges of rubber inner tubes are the same. Although the two manufacturers use different trademarks, they both produce tubes of the same standard and quality level, enjoy the same reputation, and are both used by motor vehicle manufacturers in the importing country. According to the Article 15.2 (a) of the The Agreement on Customs Valuation, because inner tubes bear different trademarks, they are not identical in every respect and should not be regarded as the same goods. Although the inner tubes are not identical in every respect, they do share similar characteristics and component materials, so that they can perform same function. Since the goods are produced to the same standard and quality level and have the same level of reputation and bear trademarks (even if the marks are different), they shall be identified as similar goods.

2. Manufacturer and origin: the goods shall be manufactured in the same country or region. Specifically, the transacted price for identical or similar goods produced by the same manufacturer shall be applied first. Where there is no such transacted price for identical or similar goods produced by the same manufacturer, the transacted price of identical or similar goods produced by other manufacturers in the same manufacturing country or region may be used. 3. Time: the goods shall be imported at the time of importation or roughly around the same time. “Around the same time” shall mean a period of 45 days before and after acceptance by the Customs of the declaration for the goods. 4. Adjustment: it shall be or adjust to the same commercial standards and approximately import quantities. (1) The transacted price of identical or similar goods which are equal in commercial standards and basically consistent in import quantity shall be used. (2) In the absence of the aforementioned transacted price of identical or similar goods, transacted price of identical or similar goods at different commercial standards or in different import quantities may be used. Tips: There are applicable conditions for Customs to accept the above 4.(1) or 4.(2) to determine the transacted price of imports, that is, relevant difference factors -- such as differences in price, cost and other expenses caused by different commercial standards, import quantity, transportation distance and transportation mode must be taken into account, and relevant factors should be adjusted as necessary. And the adjustment should be based on the enterprise can provide objective quantitative data. 5. Other considerations For example, where there are a few transacted prices of identical or similar good, the examination and determination of the dutiable value of imports shall be based on the lowest transacted price.

Ⅲ. The Chargeback Price Valuation Method

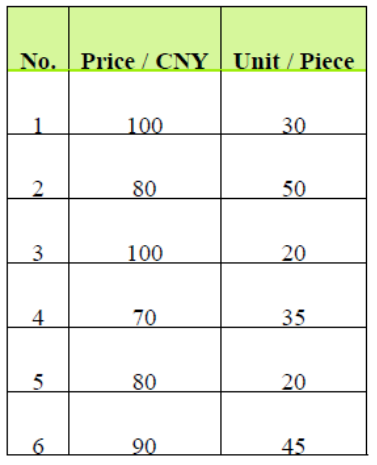

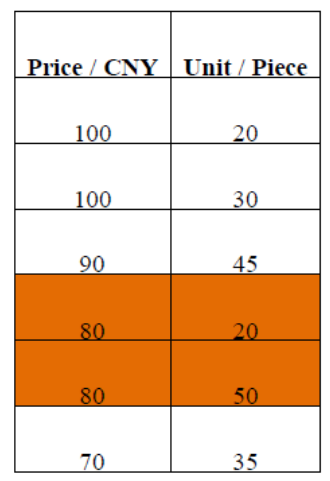

(Ⅰ) Definition The chargeback price valuation method shall mean the valuation method adopted by the Customs for examination and determination of the dutiable value of imports on the basis of the selling price of the imports or identical or similar imports in China less the relevant expenses incurred in China. (Ⅱ) Applicable conditions The selling price shall satisfy the following criteria simultaneously: 1. The selling price of such goods at the time of importation or roughly around the same time. The selling price of such goods, identical or similar imports in China at the time of importation or roughly around the same time. “Around the same time” shall mean a period of 45 days before and after acceptance by the Customs of the declaration for the goods. If there is no referable sales price at or about the time of the importation of the goods, the price within 90 days after the import of the goods can be applied as the basis of the chargeback price valuation. In terms of the time factor, the chargeback price valuation method is more flexible than the valuation method using the transacted price of identical or similar goods. The provision, “If the selling price at the time or roughly around the same time of the importation of goods can not be found, the price within 90 days after the import of the goods can be used as the basis of the chargeback price valuation”, can be applied under this condition. 2. The selling price based on the conditions of the goods at the time of importation. If such goods, identical or similar goods, were not sold in China in accordance with the conditions at the time of importation, at the request of the taxpayer, the selling price of the goods following further processing may be used for examination and determination of the dutiable value but the value-added amount from processing shall be deducted simultaneously. Computation of the value-added amount from processing shall be based on objective and quantifiable data related to the processing cost, the standard and computation method recognized by the industry and other industry practices. 3. The selling price of goods at which the aggregate sales volume is the largest. That is to say, using the chargeback price valuation method must base on the price of the imports or their identical or similar goods sold to the parties without special relationship in China in the largest total amount. For example, Company A has sold 200 units of imports in six batches at different prices, as follows:

The above sales price of CNY 80 is the largest total unit, a total of 70. (see the table below)

Therefore, the goods sold in the largest aggregate quantity is at the price of CNY 80. 4. When applying the chargeback price valuation method, in addition to meeting the above three conditions, it shall also meet all of the following conditions: the selling price during the first sales cycle in China, the selling price offered to a party in China which does not have a special relationship with the seller. These two conditions are easy to understand from the perspective of fair trade, so we will not go into more details here. (Ⅲ) Expenses that shall be deducted Where the chargeback price valuation method is used for examination and determination of the dutiable value of imports, the following items shall be deducted: (1) the normal profits and general expenses of same grade or type of goods sold in China during the first sales cycle in China (including direct expenses and indirect expenses) and commission paid generally; (2) transportation and related expenses and insurance premium after unloading of the goods following arrival in China; and (3) import tariff, import-linked taxes levied by the Customs and other taxes in China. Accounting principles and methods consistent with recognised accounting principles in China shall be used for determination of items to be deducted.

Ⅳ. Computed Price Valuation Method

(Ⅰ) Definition The computed price valuation method whereby the Customs examine and determine the dutiable value of imports based on the aggregate of the following items: (II) Price composition 1.Material costs and processing fees incurred for manufacturing of such goods; 2. Normal profits and general expenses (including direct expenses and indirect expenses) for selling goods of same grade or type in China; and 3. Transportation and related expenses, and insurance premium prior to the unloading of such goods following the arrival in China. When examining and determining the dutiable value of imports, the Customs may verify the relevant materials provided by such enterprise overseas after obtaining the consent of the overseas manufacturer and notifying the government of the country or region in advance. The principles and methods consistent with the accounting principles recognized by the country or region of manufacture shall be determining the relevant value or expense.

V. Reasonable method

(Ⅰ) Definition Reasonable method shall mean the valuation method adopted by the Customs for examination and determination of the dutiable value of imports based on objective and quantifiable data in accordance with the principles of objectiveness, fairness and unity when the Customs is unable to adopt the transacted price valuation method, valuation method using the transacted price of identical goods, valuation method using the transacted price of similar goods, chargeback price valuation method, and computed price valuation method for determination of dutiable value. (Ⅱ) The following price shall not be used The Customs shall not use the following prices when adopting the reasonable method to determine the dutiable value of imports: 1. Domestic selling price of domestically produced goods; 2. The higher price out of available prices; 3. Selling price of the goods in the market of the origin of export; 4. The price of identical or similar goods computed using value of expenses other than computed price valuation method; 5. Selling price of goods exported to a third country or region; or 6. Minimum price or arbitrary or suppositious price. Reference: [1] Examples and analysis from the WCO Customs Valuation Technical Committee's document - Comment 1.1 [2] Examples and analysis from the WCO Customs Valuation Technical Committee's document - Comment 1.1 Conclusion

1.Although the transacted price valuation method is the most frequently one used in Customs valuation, in practice, due to a variety of factors, such as no transacted price, transacted price does not satisfy the applicable conditions, transacted price can not be determined, etc., Customs is often unable to adopt the valuation method using transacted price of imports and exports. In this case, the dutiable price will need to be re-determined and Customs valuation methods other than using the transacted price will be applied in turn. 2. This notes briefly introduce other Custom valuation methods, mainly including valuation method using transacted price of identical goods, valuation method using transacted price of similar goods, chargeback price valuation method, computed price valuation method, and reasonable method.